When Renaissance Technologies Tanked Their Fund

Described in "Truth Engine: Applying AI to Investing", tribulations rocked the premier machine learning firm.

It was a sunny day on Wall Street, and the machine was learning. In nearby Long Island, a small group of mathematicians led by an erstwhile Stony Brook department chair implemented what would be wildly successful learning algorithms on market data. While strategies such as mean regression, that a company usually returned to the average of its peers, were widely analyzed, for the first time the strategy could adjust its own parameters. Such automation removed the slow reaction times of human input. Yet in terms of broader impact, Renaissance Technologies’ methods fell short. Firms like Citadel torpedoed market liquidity benefits via algorithmic front-running.1 When Renaissance launched their value fund, the Institutional Equities Fund, it failed to deliver on their expectation. Shortly after creation, the fund dropped 8.7% in the single month of August 2007 and worse, lagged the market by 10%.2 Their ambition of a large capacity value-based fund in the vein of Benjamin Graham and Warren Buffett outran the technology available. Two subsequent breakthroughs in AI would realize the methods for intrinsic value discovery as practiced by the greats, and in the course, empower the individual value investor to conquer markets.

Famed investors Howard Marks, Buffett, and Charlie Munger outline a view of intrinsic value investing that supersedes value investing taught in neat bundles. Their method of investing, even while rooted in valuation methods that hark back to hard and fast rules like Graham’s requirements on price to book, goes a step beyond. Buffett has been quoted “Read 500 pages every day”.3 In “The Most Important Thing”, Marks writes:

In fact, one of the things I most want to emphasize is how essential it is that one's investment approach be intuitive and adaptive rather than be fixed and mechanistic.

- Chapter 1, Second Level Thinking

Marks provides the on-ramp for our emphasis – if we’re to use quantitative tools in an investing approach, they should be adaptive, generally intelligent methods.

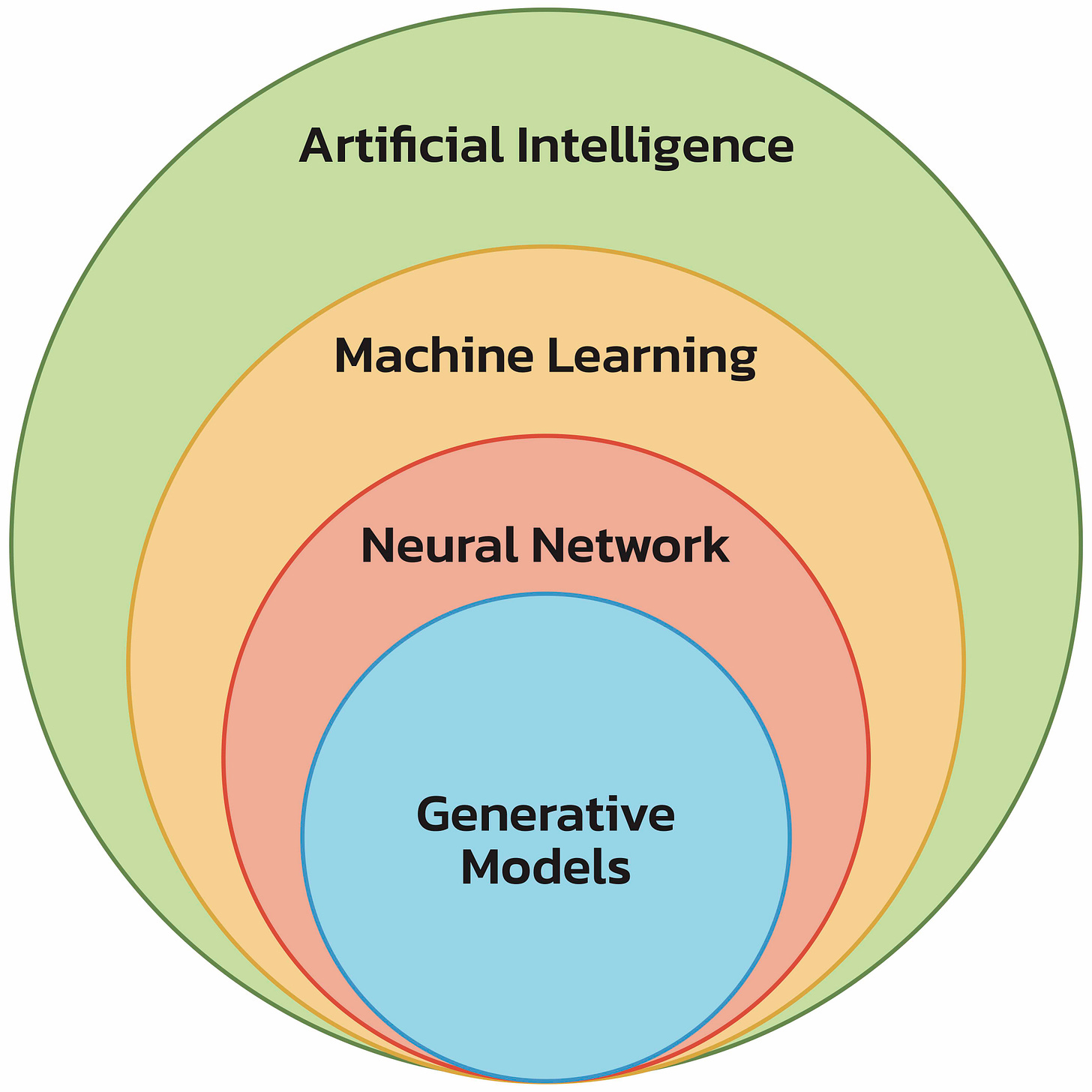

There are many AI doomsayers that say the machine will replace humans. Currently, we know of no machine learning (ML) systems acting on the market that are not intermediated by the designers at some level. Gregory Zuckerman writes that founder Jim Simons pulled the plug on the Renaissance system when drawdown exceeded 20% in a month.4 When questioned by his lieutenants, Simons gruffly replied, “I would do it again”. Simons had built a world-class quantitative team. In balance, we have access to LLMs and generative AI tools that the Renaissance team could only have imagined (fig. 1). Yet access to tools is not enough. Equally important is the understanding and experience that elevates the apprentice to artisan.

Figure 1: Data-driven techniques to improve return, reduces investment doubling time. The techniques require critical thinking and provide a framework for an investor to improve. Like diet and exercise, expected gains vary by diligence and effort.

The Roman philosopher Seneca relates the parable of seeking wisdom from Socrates. In the story, a young man approaches Socrates, then a famed philosopher and leader of the Athens School of Philosophy. “Socrates, I thirst for wisdom. Please give it to me”. Socrates makes an appointment with the young man to meet at the River Eridanos at dawn. When they met, Socrates, a burly man, plunged the young man under water and held him there. Finally the young man surfacing and gasping, half assaulted Socrates. Again holding him, Socrates delivered the message, “when you want wisdom as much as you wanted to breathe, you’ll attain it.” Typically, knowledge isn’t equated with wisdom. Socrates had wisdom, for which knowledge is a precursor. Socrates led a school of professionals, which through his dialectic, shaped his teachings. At Nvidia where I worked, the CEO employed the World Wide Field Operations division, essentially a global real-time knowledge collection apparatus. As individual or even professional investors, we likely don’t have the resources to build an organization rivaling a Fortune 10 company, yet we have an equal thirst for knowledge as any executive. The argument that investors don’t need a world class information apparatus is defeated by Buffett's inspiration to be 15% Philip Fischer . Fischer, active from the early half of the century, made the case for the “scuttlebutt” approach, the practical gumshoe methods of collecting information ahead of broad market discovery.5 Knowledge and information are the hallmarks of good investment. The promise of new ML tools is that some alchemy of knowledge to wisdom can be shouldered by good systems.

However beneficial, Socrates and his philosophy can be removed from daily professional life. To understand generative AI tools, imagine instead you're a mid-career working professional in software development, who's recently welcomed a junior developer, Earnest. Earnest is good, that's why you hired him, but you know he's green. Further, you're at the peak of your skills– you're pretty sure that you know more than the new guy. But he has such new ideas maybe picked up with recent coursework distilled from the latest studies. The new guy never seems to get the task exactly right, but he really gives it a good effort and sometimes his effort launches a project to the next level. You'll keep him around. Besides, our increasingly multi-disciplinary workplace requires flexible brain power to accelerate time to solution. The power of generative AI is that it applies to the vast majority of knowledge work all at once.

Figure 2: Hierarchy of AI technology

To understand the origin of generative AI (fig. 2), we trace ML methods that have already achieved results eluding teams of elite programmers. The first breakthrough occurred with convolutional neural networks (CNNs) that stacked neural network (NN) layers for deep learning (DL) models. Such models are effective for analyzing visual imagery. CNNs improved the accuracy of image classification tasks, reaching renown in the global ImageNet competition. There is a joke in the pre-DL era that a sophisticated geolocation photo application could be prototyped in a week whereas determining the species of birds in a photo would require a team of world-class computer scientists.6 During my graduate work, teaching computers to see meant using complex visual flow mathematics, tracking the vector fields between pixel values. Alex Krizhevsky, a researcher at the University of Toronto, ushered a Galilean-scale breakthrough by mastering new computational hardware to implement NNs.7

In particular, generative AI uses natural language (NL) as an interface. In mid 2023, the Writer's Guild embroiled the entertainment industry in a strike with generative AI as a core issue. Yet the strikers haven't demanded a complete ban. Since using generative AI is as easy as speaking, there are no wrong ways to use generative AI, only more or less optimal patterns (Chapter 10). Second, NL models have reached par or exceeded human level performance for narrow tasks as measured by the Stanford General Language Understanding Evaluation (GLUE) benchmark.8 The SuperGLUE benchmark is the second-generation understanding benchmark covering ten tasks including sentiment analysis, entailment (does one phrase imply another), co-reference resolution (was a reference to an earlier mention identified correctly), reading comprehension with common sense reasoning, etc. As most investing texts emphasize a comprehensive and common sense approach, the stage is set for NL and generative AI approaches to create impact in intrinsic value investing.

“Truth Engine: Applying AI to Investing” now available everywhere books are sold: https://www.amazon.com/Truth-Engine-Applying-AI-Investing-ebook/dp/B0CMQ1K6QX

Michael Lewis. Flash boys: a Wall Street revolt. WW Norton & Company, 2014

https://archive.ph/yarhu

https://archive.ph/x762p

Gregory Zuckerman. The man who solved the market: How Jim Simons launched the quant revolution. Penguin, 2019

Philip A Fisher. Common stocks and uncommon profits and other writings, volume 40. John Wiley & Sons, 2003

https://xkcd.com/1425/

Alex Krizhevsky, Ilya Sutskever, and Geoffrey E Hinton. Imagenet classification with deep convolutional neural net- works. Communications of the ACM, 60(6):84–90, 2017

https://super.gluebenchmark.com/